|

12/3/2023

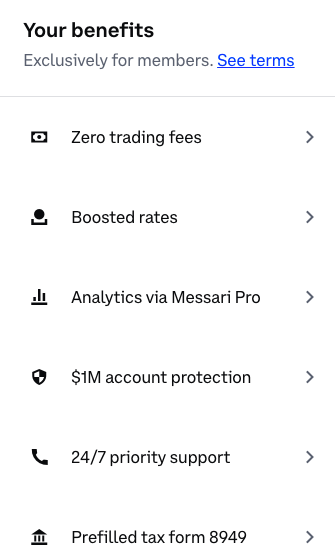

Bitcoin: A Journey Through Time - From White Paper to Global Phenomenon [FREE BITCOIN TUTORIAL] Get Started On Crypto And Web 3 On Coinbase One Get Started On Crypto And Web 3 On Coinbase One If you enjoyed our FREE BITCOIN TUTORIAL, feel free to share it with your loved ones. **Disclaimer:** Before we delve into the fascinating world of Bitcoin and cryptocurrencies, it's crucial to remember that investing always carries risks. The cryptocurrency market is known for its volatility, and prices can fluctuate significantly. Always do your research and consider seeking professional financial advice before making any investment decisions. The information provided in this tutorial is for educational purposes only and should not be considered as financial advice. **Introduction: The First Bitcoin Transaction - A Pioneering Moment** The inception of Bitcoin marked a groundbreaking era in the history of finance. The first-ever Bitcoin transaction was not just a simple exchange; it laid the foundation for a revolutionary concept – digital currency. Fast forward to today, and Bitcoin has evolved into a global phenomenon, shaping the way we perceive and use money. Some lucky people have reason to celebrate. Since it first started trading on an exchange, the token is up 3,449,989,839%. **Bitcoin and Satoshi Nakamoto's White Paper: 15 Years Ago to Now** In 2008, an anonymous individual or group using the name Satoshi Nakamoto introduced a white paper outlining the concept of Bitcoin. Little did the world know that this would transform into one of the most valuable assets. Bitcoin has transcended its early days of obscurity to become a mainstream digital currency, accepted by major corporations like PayPal and Chase. As of now, over 19.56 M million Bitcoins circulate, 757.59B, down from and up from 325.81B one year ago. Bitcoin's journey from a white paper to the mainstream financial system is a testament to its enduring impact. **Understanding Bitcoin: The Basics** 1. **Decentralization and Peer-to-Peer Transactions:** Bitcoin operates on a decentralized network, allowing users to transact directly without intermediaries like banks. Transactions are secured through cryptography and recorded on a public ledger called the blockchain. 2. **Invention and Release:** Bitcoin emerged in 2009 when its source code was released as open-source software by the mysterious Satoshi Nakamoto. 3. **Store of Value:** Often compared to gold, Bitcoin shares similarities as a scarce asset resistant to inflation. However, it goes beyond gold by functioning as both a store of value and a payment system. **Bitcoin's Impact on the Fiat System** While early debates centered on whether Bitcoin could replace fiat currency, it's now apparent that Bitcoin might complement and enhance the existing system. Here's how: 1. **Increased Transparency:** Bitcoin's public ledger ensures transparent recording of transactions, countering potential central bank manipulations in fiat currencies. 2. **Reduced Costs:** Bitcoin facilitates low-cost international transfers compared to traditional wire transfers, potentially encouraging wider adoption. 3. **Inflation Protection:** With a capped supply of 21 million coins, Bitcoin is immune to inflationary pressures, providing a potential hedge against currency devaluation. **Crypto vs. Cash: A Comparative View** Bitcoin's resilience amid economic uncertainties prompts the question: Is it better than holding cash? 1. **Value Stability:** While Bitcoin has experienced volatility, it has shown resilience during economic downturns compared to traditional cash. 2. **Portability:** Digital wallets make crypto more portable than physical cash, allowing easy storage and access. 3. **Divisibility:** Crypto's divisibility allows users to split assets for transactions or trading, offering more flexibility than cash. Ultimately, the decision between crypto and cash depends on individual preferences and investment goals. **Investing in Cryptocurrency vs. Gambling: Understanding the Difference** 1. **Investing:** Involves buying assets with the expectation of long-term value growth. It requires research, analysis, and a willingness to hold onto investments. 2. **Gambling:** Involves placing bets on events with the hope of winning money, often relying on luck. Short-term gains may occur, but there's no guarantee of long-term profitability. Choosing between investing and gambling depends on personal goals and risk tolerance. Cryptocurrency investment, though riskier, can be rewarding with informed decisions. Certainly! Let's break down the concepts of a bull market and a bear market in the context of the cryptocurrency market, with a focus on Dollar-Cost Averaging (DCA) and strategic investment timing around Bitcoin halving events. **Bull Market: Riding the Upswing** **Definition:** A bull market refers to a sustained period of rising prices in the financial market. In the context of cryptocurrencies, it means that the overall market sentiment is positive, and asset prices are generally increasing. **Key Characteristics:** 1. **Optimism and Confidence:** Investors are optimistic about the market's future, and there's a general confidence in the potential for returns. 2. **Increasing Demand:** More investors are entering the market, leading to higher demand for cryptocurrencies. 3. **Rising Prices:** Cryptocurrency prices tend to rise consistently during a bull market, creating opportunities for profitable trades and investments. **Dollar-Cost Averaging (DCA) in a Bull Market:** DCA involves investing a fixed amount of money at regular intervals, regardless of the asset's price. In a bull market, DCA can be a prudent strategy because: - **Mitigates Timing Risk:** Since prices are generally rising, DCA reduces the risk of making a substantial investment at the peak. - **Consistent Accumulation:** Regular investments allow you to accumulate assets over time, benefiting from the overall upward trend. **Bitcoin Halving and Bull Markets:** Bitcoin halving events, which occur approximately every four years, involve a reduction in the reward miners receive for validating transactions. Historically, these events have been associated with bull markets. Here's why: 1. **Supply Shock:** Halving reduces the rate at which new Bitcoins are created, creating a supply shock. If demand remains constant or increases, this can lead to upward pressure on prices. 2. **Market Perception:** The anticipation of reduced supply often leads to increased interest and demand among investors, contributing to a bullish market sentiment. 3. **Long-Term Impact:** Previous halving events have preceded extended bull markets, suggesting a correlation between the two. **Bear Market: Navigating the Downturn** **Definition:** A bear market is characterized by a prolonged period of falling asset prices. In the cryptocurrency context, it means that the overall market sentiment is negative, and prices are generally declining. **Key Characteristics:** 1. **Pessimism and Fear:** Investors are pessimistic about the market's future, leading to fear and a lack of confidence. 2. **Decreasing Demand:** Investors may exit the market, leading to lower demand for cryptocurrencies. 3. **Falling Prices:** Cryptocurrency prices tend to decline during a bear market, creating challenges for investors. **DCA in a Bear Market:** While DCA is often associated with bull markets, it can also be a valuable strategy in a bear market: - **Risk Mitigation:** DCA helps mitigate the impact of short-term price volatility by spreading investments over time. - **Lower Average Cost:** Buying when prices are lower can result in a lower average cost per unit of cryptocurrency. - **Long-Term Perspective:** For investors with a long-term perspective, bear markets can present opportunities to accumulate assets at discounted prices. **Investing Around Bitcoin Halving and Market Tops:** 1. **Post-Halving Accumulation:** Historically, after a Bitcoin halving, prices have tended to rise. Investing during the post-halving period can position investors for potential gains as demand increases. 2. **Market Tops and Caution:** As markets reach new highs, caution is advised. DCA can still be employed, but investors should be mindful of potential corrections or shifts in market sentiment. 3. **Balancing Risk and Reward:** Understanding the market cycle and being aware of potential tops can help investors make informed decisions. DCA allows for a balanced approach to risk and reward. **Conclusion: Balancing Strategies for Wealth Creation** In the dynamic world of cryptocurrencies, understanding the cycles of bull and bear markets is crucial for effective investment strategies. Dollar-Cost Averaging provides a disciplined approach, allowing investors to navigate both market upswings and downturns. Strategic investment around Bitcoin halving events can be an additional factor to consider, but always conduct thorough research and consider your risk tolerance before making investment decisions. Bitcoin has come a long way in its relatively short existence. From its mysterious beginnings to global acceptance, its impact on the financial landscape is undeniable. As businesses adopt Bitcoin and more individuals explore cryptocurrencies, it's evident that Bitcoin is a lasting force. The future holds exciting possibilities for this digital pioneer, and only time will reveal the next chapter in Bitcoin's remarkable journey. Our top 12 Crypto Pick For 2024 Halving and 2025 Bull Market! Bitcoin BTC Ethereum ETH Solana SOL Chainlink LINK Immutable X IMX Avalanche AVAX XRP XRP Cardano ADA ApeCoin Crypto.com Coin Fetch.ai FET Dogecoin DOGE Full Disclosure: We're invested in all these Crypto and may invest in more altcoin between the time of publication of this tutorial and 2025. If you want to invest safely we highly recommend COINBASE ONE (UP to $1 Million Account Protection and other member benefits best suited if you trade often, since all transaction are free) Weekly and monthly opt-in options to earn free BITCOIN, USDC and more just by learning about crypto. See COINBASE terms of services TOS and what promotions are available in your area, when you read or watch this tutorial To your success. Djamee |

hot trillion blogThe Highest quality; potential or result is the standard here. Email our admin Djamee at [email protected] for placement and editorial opportunities on HotTrillion.com Archives

February 2024

CategoriesAll 000 Dolars 33K Bitcoin 7 Reasons To Invest In Gold Ada Aka Automobile Storage Vehicle Storage Airport Parking Indoor Car Storage Auto Storage USA Awn Powered By Stellar Billions Bitcoi Correction Bitcoin Bitcoin All Time High Bitcoin Etf Bitcoinlaser Eyes To 100K Bitcoin President Of El Salvador Bitcoins Millions Bitcoinspot Etf Bitcoin To 100 Blockchain Blockchains Blockchain Technology Blockchain Trchnology Btc Bukale Re Elected In El Salvador Can Cardamon Hit $10 Cardano Cardano Africa Cardanoafrica 2021 Cardano Africa Announcement Cardano Africa News Cardano Africa Plan Cardanoafrica Project Cardanoafrica Special Cardano Crypto Revolution In Africa Cardano Hottrillion.com Cardanoreddit Charles Charles Hoskinsonn Coinbase Crypto Cryptocurrency Crypto Exchange FTX Dav Davor Davor Coin Decentralized Blockchain Cardano Defi Developers Dr G Jones Ethiopia Faares Quadri Get Free Bitcoin Hodl How Can I Buy Akon Akoin How To Buy Ada How To Buy Cardano How To Lend On Davor How To Make Money Online Investment Investment Platform Is Cardamon Better Than Bitcoin Is Cardano A Good Investment In 2021 Laser Eye Mainnet Millionnaires Millions Nlp Rising Stars Sam Bankman-Fried Slall Conrect Topcrypto Trillion Trillions Vanguard What Is Cardamon Worth In 2025 What's Happening In Africa With Ada Cardao When To Buy Cardano Worldcoin Worldcoin $5million Dollars Grant Worldcoinfondation |

HotTrillion.comHotTrillion © is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designated to provide a means for sites to earn advertising fees by advertising and linking to amazon.com |

|

© 2017 HotTrillion.com. All Rights Reserved. Powered By Djamee Enterprise

RSS Feed

RSS Feed