|

4/15/2024

Hong Kong Approved A Spot Bitcoin ETFs and Spot Ether ETFs managed by China Asset Management, Harvest Global, Bosera and HashKey on Monday.As predicted on Hottrillion.com a few months ago Hong Kong has approved first batch of spot bitcoin, ether ETFs in drive to become crypto hub. A big distinction between the USA Spot ETFs and the Hong Kong ETFs is the later will be traded "In Kind;" not "Fiat."

In other words when you trade your Bitcoin and Ether spot ETFS, you get paid in Crypto. A significant contrast with the US Spot ETFs that pays in Fiat/ Dollars. Hong Kong takes the lead with their Ether ETFS as SEC is now lagging and falling behind. They have not made a decision in favor or against the 2nd Crypto ETHEREUM Spot ETF applications. The asset has lost a lot in market cap value in recent weeks. With this financial news we anticipate a surge in Ethereum (ETH) and Bitcoin (BTC) transactions amid a volatile market in recent days. For more Alpha follow On X Twitter and Facebook or Instagram @HotTrillion Please watch the short video and decide if you are ready to protect your privacy and security by clicking the buttons bellow. When you join using our partners you get 3 to 4 months free depending on the promotion and of course you support our website. -Djamee  President Nayib Bukele Wins Re-election In El Slavador- Photo Credit AP. President Nayib Bukele Wins Re-election In El Slavador- Photo Credit AP. Nobody Likes to hear I told you so! Thousands of Bukele’s supporters clad in cyan blue and waving flags thronged San Salvador’s central square to celebrate his re-election, which the 42-year-old leader termed a “referendum” on his government. Bukele declared himself the winner before official results were announced, claiming to have attained more than 85% of the vote. Provisional results showed Bukele winning 83% support with 31% of the ballots counted. Here at hottrillion.com we have always supported President Bukele's trailblazing vision on Bitcoin when he became the first. head of state to declare Bitcom #BTC the legal tender currency of his country. he did it at the peak of the last Bitcoin cycle and proceeded to DCA for two years during a bear market. While it may have looked like a disaster in the making, the FMI knocked at his door; Bitcoin fell at that time so far down as $25.000. But the young president had done his homework. He knew that the "Digital Gold " Wonder coin is coded to grow and with it's finite supply and the facto decentralized essence, is poised to do just what it was created to do in this cycle; REVOLUTIONIZE the way we think about commodity and financial assets. His bet paid off and the country's Bitcoin treasury is already in profit. He also made his country more attractive by offering citizenship to those willing to invest in it for about a million dollars, and an advantageous tax system for Crypto Corporations moving their headquarters there. This is good news for Bitcoin because a lot of analysts were on the fences on whether this experiment would prove to be a success in real-time or a complete failure. The results are that Being a Bitcoin President and adopter is good for a sovereign country. If you would like to find out more about BITCOIN, watch or read our Free BITCOIN tutorial here. At the end of the presentation, Djamee offers the altcoin pick that he believes will have a fantastic run in 2024. The list is only available at the bottom of the blog post. We will be back weekly on Monday so we will see you then or if we have breaking news to share with you. Thank you for your like and share.

1/13/2024

Why Vanguard's Avant-Garde Approach May Deny Clients the New Regulated Bitcoin ETFOn Thursday, January 10th, 2024, a wave of confusion swept potential traders when they discovered that Vanguard asset managers were not offering a spot BTC ETF to their clients. In fact, they were simply reaffirming a statement made six years ago: "We will never offer any ETF Bitcoin products…" This narrative has been prevalent among financial institutions for the past decade, with some only permitting their top-tier clients to dabble in crypto exposure. However, at this juncture, Bitcoin stands as a confirmed regulated commodity, traded alongside gold, oil, and various other assets. Vanguard's stance could potentially go against the best interests of its clients, an opinion I find outright ignorant. It reminds me of companies that refused to integrate the Internet in the early 80s—companies that are now nowhere to be found. Similar to owning a piece of internet real estate with a domain name and a website connected to a major social media presence, individuals and companies will gradually include Bitcoin in their investment strategies, even if only by 1%. On X, formerly Twitter, #boycottvanguard started to trend, with disgruntled clients confirming the closure of their Vanguard accounts. In the short term, Vanguard, a multi-trillion-dollar asset management company, may not care about not accepting Bitcoin, but this resistance is reminiscent of those who clung to horses rather than embracing Ford Cars in the past. What about electric cars? Tesla founder Elon Musk, in a space interview with Ark's founder, expressed that he could see Bitcoin being used, especially when it comes to X. Bitcoin, in its purest form created by Satoshi Nakamoto (whether an individual or a group of anonymous cyberpunks) in 2008, was anti-establishment. Its white paper was a response to the financial institution follies that led to the fall of banks in 2008 and the burst of the mortgage bubble in 2009. Without a bailout, all the top 500 S&P companies would have vanished. With its finite quantity, Bitcoin stands in stark contrast to the infinite possibility of printing fiat. Positioned as digital gold, Bitcoin is now a confirmed commodity and a proven hedge against inflation. I am intrigued to see how Vanguard will maintain its position as the second-largest asset management institution in the world in the next five years when BlackRock, the leading institution, successfully led a group of 11 companies to have their Bitcoin ETF applications approved by the SEC in the USA. The Bitcoin Spot ETF is already trading with a staggering $4.6 billion first-day volume. I'm curious to observe how Vanguard will remain a significant financial player by persisting in denying Bitcoin to its clients, especially when approximately 10 Bitcoin Spot ETFs are poised to be approved in Hong Kong in the next two weeks, as of the time of this entry. In the meantime, you can follow us on IG, X, and here. Don't forget to read or watch our Bitcoin tutorial on our website and check out DJAMEE's altcoin picks for 2024. Click to watch.

12/4/2023

Web3 Attribution Platform Spindl Teams Up With AppsFlyer to Improve Blockchain Gaming Analytics Spindl, an attribution and analytics platform looking to improve how marketing for Web3 games, has teamed up with AppsFlyer, a company which has done something similar over a number of years in the Web2 world. AppsFlyer has been providing attribution - the process of determining which marketing techniques are turning into sales - for mobile gaming since 2011, for which it has raised $300 million in venture capital. Spindl was formed two years ago from the aim to build a Web3-native version of this sort of platform that blockchain-based games can use as a basis for their strategy. [Read More] Cherry Blossom Xbox Elite Series 2 Controller: Xbox Elite Controller 2

The grants are supposed to give developers a “focus on building resilient technology and more equitable systems.” The Worldcoin Foundation, a non-profit that supports the development of the Worldcoin protocol, announced on Wednesday a $5 million community grants program called “Wave0.” The grants are supposed to give developers a “focus on building resilient technology and more equitable systems” on Worldcoin, according to a draft press release seen by CoinDesk. The foundation will commit $5 million in funding across three grant tracks, and will be made in WLD token, the native token for the Worldcoin protocol, which runs on the Ethereum blockchain. Remco Bloemen, the head of protocol at the Worldcoin Foundation, told CoinDesk in an interview that the grants are not just aimed at developers, but that “there's a larger community effort here to be made, which is also like raising awareness, educating people of the importance” of the work the technology tries to solve, in terms of “income inequality, governance and other existential risks.” The grants will be given to projects that are looking into research and development efforts, such as the intersection of privacy and biometrics, Bloemen said. Other grant recipients could be those who come up with use cases that leverage Worldcoin and World ID. This news comes as Sam Altman, the co-founder of Tools for Humanity, which is the primary developer firm behind Worldcoin, found himself in a messy kerfuffle with OpenAI, after initially being fired and then eventually rehired as CEO. [READ MORE] On a sunny morning last December, Iyus Ruswandi, a 35-year-old furniture maker in the village of Gunungguruh, Indonesia, was woken up early by his mother. A technology company was holding some kind of “social assistance giveaway” at the local Islamic elementary school, she said, and she urged him to go. Ruswandi joined a long line of residents, mostly women, some of whom had been waiting since 6 a.m. In the pandemic-battered economy, any kind of assistance was welcome. At the front of the line, representatives of Worldcoin Indonesia were collecting emails and phone numbers, or aiming a futuristic metal orb at villagers’ faces to scan their irises and other biometric data. Village officials were also on site, passing out numbered tickets to the waiting residents to help keep order. Ruswandi asked a Worldcoin representative what charity this was but learned nothing new: as his mother said, they were giving away money. Gunungguruh was not alone in receiving a visit from Worldcoin. In villages across West Java, Indonesia—as well as college campuses, metro stops, markets, and urban centers in two dozen countries, most of them in the developing world—Worldcoin representatives were showing up for a day or two and collecting biometric data. In return they were known to offer everything from free cash (often local currency as well as Worldcoin tokens) to Airpods to promises of future wealth. In some cases they also made payments to local government officials. What they were not providing was much information on their real intentions. This left many, including Ruswandi, perplexed: What was Worldcoin doing with all these iris scans? To answer that question, and better understand Worldcoin’s registration and distribution process, MIT Technology Review interviewed over 35 individuals in six countries—Indonesia, Kenya, Sudan, Ghana, Chile, and Norway—who either worked for or on behalf of Worldcoin, had been scanned, or were unsuccessfully recruited to participate. We observed scans at a registration event in Indonesia, read conversations on social media and in mobile chat groups, and consulted reviews of Worldcoin’s wallet in the Google Play and Apple stores. We interviewed Worldcoin CEO Alex Blania, and submitted to the company a detailed list of reporting findings and questions for comment. Our investigation revealed wide gaps between Worldcoin’s public messaging, which focused on protecting privacy, and what users experienced. We found that the company’s representatives used deceptive marketing practices, collected more personal data than it acknowledged, and failed to obtain meaningful informed consent. These practices may violate the European Union’s General Data Protection Regulations (GDPR)—a likelihood that the company’s own data consent policy acknowledged and asked users to accept—as well as local laws. In a video interview conducted in early March from Erlangen, Germany, where the company manufactures its orbs, Blania acknowledged that there was some “friction,” which he attributed to the fact that the company was still in its startup phase. “I'm not sure if you're aware of this,” he said, “but you looked at the testing operation of a Series A company. It’s a few people trying to make something work. It’s not like an Uber, with like hundreds of people that did this many, many times.” Proof of personhood Two months before Worldcoin appeared in Ruswandi’s village, the San Francisco–based company called Tools for Humanity emerged from stealth mode. Worldcoin was its product. The company’s website described Worldcoin as an Ethereum-based “new, collectively owned global currency that will be distributed fairly to as many people as possible.” Everyone in the world would get a free share, the company suggested—if they agreed to an iris scan with a specially designed device that resembles a decapitated robot head, which the company refers to as the “chrome orb.” The orb was necessary, the website continued, because of Worldcoin’s commitment to fairness: each person should get his or her allotted share of the digital currency—and no more. To ensure there was no double-dipping, the chrome orb would scan participants’ irises and several other biometric data points and then, using a proprietary algorithm that the company was still developing, cryptographically confirm that they were human and unique in Worldcoin’s database. “I’ve been very interested in things like universal basic income and what’s going to happen to global wealth redistribution,” Sam Altman, Worldcoin’s cofounder and the former President of Silicon Valley accelerator Y Combinator, told Bloomberg, which first reported on the company last summer. Worldcoin was intended, he explained, to answer the question “Is there a way we can use technology to do that at a global scale?” [READ MORE]

12/3/2023

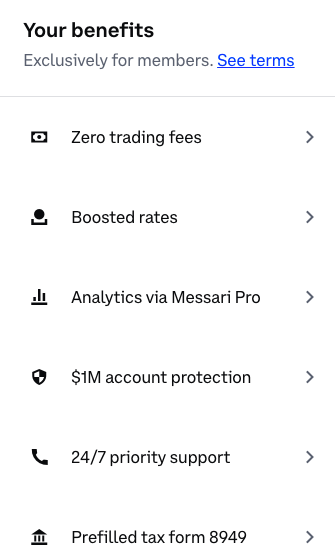

Bitcoin: A Journey Through Time - From White Paper to Global Phenomenon [FREE BITCOIN TUTORIAL] Get Started On Crypto And Web 3 On Coinbase One Get Started On Crypto And Web 3 On Coinbase One If you enjoyed our FREE BITCOIN TUTORIAL, feel free to share it with your loved ones. **Disclaimer:** Before we delve into the fascinating world of Bitcoin and cryptocurrencies, it's crucial to remember that investing always carries risks. The cryptocurrency market is known for its volatility, and prices can fluctuate significantly. Always do your research and consider seeking professional financial advice before making any investment decisions. The information provided in this tutorial is for educational purposes only and should not be considered as financial advice. **Introduction: The First Bitcoin Transaction - A Pioneering Moment** The inception of Bitcoin marked a groundbreaking era in the history of finance. The first-ever Bitcoin transaction was not just a simple exchange; it laid the foundation for a revolutionary concept – digital currency. Fast forward to today, and Bitcoin has evolved into a global phenomenon, shaping the way we perceive and use money. Some lucky people have reason to celebrate. Since it first started trading on an exchange, the token is up 3,449,989,839%. **Bitcoin and Satoshi Nakamoto's White Paper: 15 Years Ago to Now** In 2008, an anonymous individual or group using the name Satoshi Nakamoto introduced a white paper outlining the concept of Bitcoin. Little did the world know that this would transform into one of the most valuable assets. Bitcoin has transcended its early days of obscurity to become a mainstream digital currency, accepted by major corporations like PayPal and Chase. As of now, over 19.56 M million Bitcoins circulate, 757.59B, down from and up from 325.81B one year ago. Bitcoin's journey from a white paper to the mainstream financial system is a testament to its enduring impact. **Understanding Bitcoin: The Basics** 1. **Decentralization and Peer-to-Peer Transactions:** Bitcoin operates on a decentralized network, allowing users to transact directly without intermediaries like banks. Transactions are secured through cryptography and recorded on a public ledger called the blockchain. 2. **Invention and Release:** Bitcoin emerged in 2009 when its source code was released as open-source software by the mysterious Satoshi Nakamoto. 3. **Store of Value:** Often compared to gold, Bitcoin shares similarities as a scarce asset resistant to inflation. However, it goes beyond gold by functioning as both a store of value and a payment system. **Bitcoin's Impact on the Fiat System** While early debates centered on whether Bitcoin could replace fiat currency, it's now apparent that Bitcoin might complement and enhance the existing system. Here's how: 1. **Increased Transparency:** Bitcoin's public ledger ensures transparent recording of transactions, countering potential central bank manipulations in fiat currencies. 2. **Reduced Costs:** Bitcoin facilitates low-cost international transfers compared to traditional wire transfers, potentially encouraging wider adoption. 3. **Inflation Protection:** With a capped supply of 21 million coins, Bitcoin is immune to inflationary pressures, providing a potential hedge against currency devaluation. **Crypto vs. Cash: A Comparative View** Bitcoin's resilience amid economic uncertainties prompts the question: Is it better than holding cash? 1. **Value Stability:** While Bitcoin has experienced volatility, it has shown resilience during economic downturns compared to traditional cash. 2. **Portability:** Digital wallets make crypto more portable than physical cash, allowing easy storage and access. 3. **Divisibility:** Crypto's divisibility allows users to split assets for transactions or trading, offering more flexibility than cash. Ultimately, the decision between crypto and cash depends on individual preferences and investment goals. **Investing in Cryptocurrency vs. Gambling: Understanding the Difference** 1. **Investing:** Involves buying assets with the expectation of long-term value growth. It requires research, analysis, and a willingness to hold onto investments. 2. **Gambling:** Involves placing bets on events with the hope of winning money, often relying on luck. Short-term gains may occur, but there's no guarantee of long-term profitability. Choosing between investing and gambling depends on personal goals and risk tolerance. Cryptocurrency investment, though riskier, can be rewarding with informed decisions. Certainly! Let's break down the concepts of a bull market and a bear market in the context of the cryptocurrency market, with a focus on Dollar-Cost Averaging (DCA) and strategic investment timing around Bitcoin halving events. **Bull Market: Riding the Upswing** **Definition:** A bull market refers to a sustained period of rising prices in the financial market. In the context of cryptocurrencies, it means that the overall market sentiment is positive, and asset prices are generally increasing. **Key Characteristics:** 1. **Optimism and Confidence:** Investors are optimistic about the market's future, and there's a general confidence in the potential for returns. 2. **Increasing Demand:** More investors are entering the market, leading to higher demand for cryptocurrencies. 3. **Rising Prices:** Cryptocurrency prices tend to rise consistently during a bull market, creating opportunities for profitable trades and investments. **Dollar-Cost Averaging (DCA) in a Bull Market:** DCA involves investing a fixed amount of money at regular intervals, regardless of the asset's price. In a bull market, DCA can be a prudent strategy because: - **Mitigates Timing Risk:** Since prices are generally rising, DCA reduces the risk of making a substantial investment at the peak. - **Consistent Accumulation:** Regular investments allow you to accumulate assets over time, benefiting from the overall upward trend. **Bitcoin Halving and Bull Markets:** Bitcoin halving events, which occur approximately every four years, involve a reduction in the reward miners receive for validating transactions. Historically, these events have been associated with bull markets. Here's why: 1. **Supply Shock:** Halving reduces the rate at which new Bitcoins are created, creating a supply shock. If demand remains constant or increases, this can lead to upward pressure on prices. 2. **Market Perception:** The anticipation of reduced supply often leads to increased interest and demand among investors, contributing to a bullish market sentiment. 3. **Long-Term Impact:** Previous halving events have preceded extended bull markets, suggesting a correlation between the two. **Bear Market: Navigating the Downturn** **Definition:** A bear market is characterized by a prolonged period of falling asset prices. In the cryptocurrency context, it means that the overall market sentiment is negative, and prices are generally declining. **Key Characteristics:** 1. **Pessimism and Fear:** Investors are pessimistic about the market's future, leading to fear and a lack of confidence. 2. **Decreasing Demand:** Investors may exit the market, leading to lower demand for cryptocurrencies. 3. **Falling Prices:** Cryptocurrency prices tend to decline during a bear market, creating challenges for investors. **DCA in a Bear Market:** While DCA is often associated with bull markets, it can also be a valuable strategy in a bear market: - **Risk Mitigation:** DCA helps mitigate the impact of short-term price volatility by spreading investments over time. - **Lower Average Cost:** Buying when prices are lower can result in a lower average cost per unit of cryptocurrency. - **Long-Term Perspective:** For investors with a long-term perspective, bear markets can present opportunities to accumulate assets at discounted prices. **Investing Around Bitcoin Halving and Market Tops:** 1. **Post-Halving Accumulation:** Historically, after a Bitcoin halving, prices have tended to rise. Investing during the post-halving period can position investors for potential gains as demand increases. 2. **Market Tops and Caution:** As markets reach new highs, caution is advised. DCA can still be employed, but investors should be mindful of potential corrections or shifts in market sentiment. 3. **Balancing Risk and Reward:** Understanding the market cycle and being aware of potential tops can help investors make informed decisions. DCA allows for a balanced approach to risk and reward. **Conclusion: Balancing Strategies for Wealth Creation** In the dynamic world of cryptocurrencies, understanding the cycles of bull and bear markets is crucial for effective investment strategies. Dollar-Cost Averaging provides a disciplined approach, allowing investors to navigate both market upswings and downturns. Strategic investment around Bitcoin halving events can be an additional factor to consider, but always conduct thorough research and consider your risk tolerance before making investment decisions. Bitcoin has come a long way in its relatively short existence. From its mysterious beginnings to global acceptance, its impact on the financial landscape is undeniable. As businesses adopt Bitcoin and more individuals explore cryptocurrencies, it's evident that Bitcoin is a lasting force. The future holds exciting possibilities for this digital pioneer, and only time will reveal the next chapter in Bitcoin's remarkable journey. Our top 12 Crypto Pick For 2024 Halving and 2025 Bull Market! Bitcoin BTC Ethereum ETH Solana SOL Chainlink LINK Immutable X IMX Avalanche AVAX XRP XRP Cardano ADA ApeCoin Crypto.com Coin Fetch.ai FET Dogecoin DOGE Full Disclosure: We're invested in all these Crypto and may invest in more altcoin between the time of publication of this tutorial and 2025. If you want to invest safely we highly recommend COINBASE ONE (UP to $1 Million Account Protection and other member benefits best suited if you trade often, since all transaction are free) Weekly and monthly opt-in options to earn free BITCOIN, USDC and more just by learning about crypto. See COINBASE terms of services TOS and what promotions are available in your area, when you read or watch this tutorial To your success. Djamee

1/9/2023

The Three Magi The Uncensored Interview With Amazon Bestseller Author Djamee Raphael Click To Access The Three Magi Click To Access The Three Magi The Three Magi, A Story About Faith And The Revelation Of Jesus As The Son Of God" by Amazon Bestseller Author Djamee Raphael: We are usually focused on commodities, Crypto news, and Solar Energy. But an author who Speaks about "The Three Magi," who traveled from far lands and followed a celestial sign to meet Jesus and offer him gold and other presents worthy of a king is right in our alley. HT: What inspired you to write this book about the Three Magi? DR: First, thank you for having me on Hot Trillion. This is my honor. As you said the "Three Magi," are intriguing figures. Although the Epiphany is celebrated around the world every year in honor of the visit of "The Three Kings;" it turns out that the magi do not appear in the Bible. Such a big event, the apparition of an Angel to the Magi and then to Joseph prevented baby Jesus from dying. I was interested in writing about a topic that is both medieval and historic as even if The Three Magi are not in the Bible their journey is still well documented and their origin and wisdom are of timeless interest. HT: What was your most interesting research while writing this book? DR: All the research was interesting. There is little known about the Magi. Trough history nobles as the magi In the Middle East; India; And North Africa would travel with dogs. In Ethiopia, they would even travel with felines like lions and cheetahs. I wanted to introduce Egyptian tombs. Included Saluki dogs near noble individuals in all aspects of their lifestyle including their bedroom or near a throne. So I had to introduce that the dog also known as "El Saluk," must have been part of the long journey through different lands to meet the newborn King. The Saluki dog is an integral part of any wealthy and specifically noble individual coming from Persia now known as Iran/Iraq. The Saluki is known for their hunting ability, endurance; and protection ability while not being attack dogs. HT: What do you hope readers will take away from this book? DR: I hope that this "One Sitting," book reading can be an eye-opener. I believe the Bible is a useful tool. Although it is clear that no matter how many volumes you can produce, the whole world is not included in it. Like an epic story always focuses on the depiction of events surrounding the lives of certain characters; it is up to us to imagine what the writer did not pen. I hope that the visuals that are exclusive to my book are good helpers to achieve that. A trip to time and space to visualize what it would be like to be traveling in the wild only armed with faith in a bright star in the sky. HT: What message do you want to convey through this story? Have faith above anything else. Then use patience and perseverance to get exactly where you are headed. The celestial sign in the sky is a light all of us have within us if we only care to look at its light to take the next step on our journey. The whole path doesn't need to be lit up. So long as you keep that light on through applied faith, your next step shall appear to you. Know where you are going, enjoy the journey and you will certainly get to your destination. HT: What surprised you the most while writing this book? DR: That the young Jesus and his whereabouts between the age of 14 and 29 are nowhere to be found. So of course writers have speculated where the young Jesus could have been. But I found nothing that I could put in The Three Magi book as an irrefutable fact of where he was; what he was doing and whether it influenced his future Ministry. I trust that the answer is in that question: Where was he and why is it not reported? Again the student on the path of enlightenment does not need proof of where the Young Jesus is to understand why Jesus is effectively the son of God who walked on Earth and transcended the Energy of Christ. Can we send electricity or energy of any frequency without care of how it is conducted from point A to point B? No, it took years for Nikola Tesla, to demonstrate how electricity could be transmitted safely and used by humankind. he suffered the humiliation to have people less intelligent than him patenting his inventions under their own names. Thankfully we know that Nikola was the person who studied energy tirelessly to the point of using arguably similar techniques if not the same techniques of energy transmission suspected to have been available to Ancient Egyptians several millenniums ago. I would humbly suggest people witnessing the miracle of Jesus did not get the secret teachings he had. The teachings reserved for Kings which at least we know in Ancient Egypt were referred to as "Semi Gods," and their daily activity included a mandatory education from the "scribes." Get "The Three Magi, A Story About Faith And The Revelation Of Jesus As The Son Of God."

HT: What are the similarities between the life of Jesus and the Three Magi? DR: The mystery surrounding both their lives that in my opinion is subtly covered by a veil to protect it and also protect those who are not ready to understand the meaning behind it. Note they were both called "Kings" but it is clear that the Magi were not sovereign of a particular country. Rather an elite of advanced practitioners of secret doctrines and Science. During his journey, some arrogant men and women mocked Jesus as a "King, without a kingdom," Proof they were ignorant of what the Magi knew all along about the birth of Jesus and the significance for humanity to accomplish their mission to protect the newborn from King Herod. HT: How does this story fit into the Christian tradition of Epiphany? Read the book and you will see how the Epiphany is celebrated to this day every year without much explanation. HT: How could this story be useful for non-Christian readers? Everyone, no matter their belief system, can benefit from a story about individuals motivated by selfless love who rise above any obstacle to fulfill their destiny. This is a testimonial that faith is a lever that can overcome any obstacle. I believe Jesus preached to everyone who wanted to listen. At any time in history, people can benefit from hearing a story about hope, and sacrifice for the greater good. A story about ultimate love. A story that leads to the light of Christ is worth telling; no matter what your faith is. Faith is faith. Love is love. Humans discriminate. God's LOVE and CARE are Universal. HT: What are your future writing projects? I have an unpublished book at the time of this interview. "Quotes For A Wealthy Living," which I wanted to be translated by a "native Thai '' friend so that the meaning of it would not be lost in translation. I personally translated it into French since I grew up speaking French and I speak it daily with my parents and siblings. This may not be my first next project, but it is definitely in the tubes with one promise to my readers. Thanks to today's technology anyone with a smartphone device, and a WIFI connection will be able to "Share and Earn," potentially huge commissions just by doing what they do naturally. Sharing the information with their friends and people who know them. So I hope everyone is excited about it as much as I was excited to include significant events and experiences of my life through personal quotes that I know have the potential to help you dream, do and demonstrate too.  This article is a comparative view on Bitcoin's effect on the world and its effects now, 14 years later. The First Bitcoin Transaction The first Bitcoin transaction was a landmark event in the history of cryptocurrency. It proved that the concept of digital currency could be a reality, and it set the stage for the years of development that followed. Today, we may be better off than ever before thanks to Bitcoin. The cryptocurrency has come a long way since its early days, and it shows no signs of stopping. With each passing year, Bitcoin becomes more entrenched in the global financial system, and its potential grows. Who knows where Bitcoin will be in another 10 years? We can only imagine, but one thing is certain: the first Bitcoin transaction was just the beginning of something big. What Is Bitcoin And The White Paper That Satochi Nakomoto wrote This day October 31, 14 Years Ago? What started as a white paper in 2008 has now turned into one of the world's most valuable assets - Bitcoin. With little attention at first, this digital currency is now mainstream. Currently, major corporations like PayPal and Chase allow their customers to buy, sell, and use Bitcoin. Institutional investors are also starting to invest heavily in Bitcoin because they finally see how lucrative it can be on the market. It is safe to say that Bitcoin has made its way into modern times for good. Where do you think we'll be 14 years from now? There are now over 18 million Bitcoin in circulation and the network continues to grow. The total value of all bitcoins in circulation is now over $200 billion. Bitcoin is no longer a niche interest. Major financial institutions are investing in Bitcoin and its underlying blockchain technology. Nasdaq, the world’s second-largest stock exchange, has announced that it will soon allow trading in Bitcoin futures.The original Bitcoin white paper was published on October 31, 2008 by Satoshi Nakamoto. The paper laid out a roadmap for how the cryptocurrency would function and how it could be used to enable online peer-to-peer payments. While the white paper is only nine pages long, it contains a wealth of information about how Bitcoin works.Today, 14 years later, we can say that Bitcoin has made it to the mainstream financial system. It is traded on major exchanges and has gained acceptance by many businesses and individuals. While there are still some challenges to overcome, it is clear that Bitcoin has come a long way since its inception. 1. Bitcoin is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries. Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. Bitcoin was invented in 2008 by an unknown person or group of people using the name Satoshi Nakamoto, and started in 2009 when its source code was released as open-source software. Bitcoin is often called the first cryptocurrency, although prior systems existed. Bitcoin is more correctly described as the first decentralized digital currency. It is the largest of its kind in terms of total market value. Bitcoin as a Store of Value Bitcoin has often been compared to gold, and for good reason. Both assets are scarce, have a long history of being used as a store of value, and are highly resistant to inflation. However, there are also some key differences between the two assets. For one, gold is a physical commodity that must be mined from the earth, while Bitcoin is a digital asset that can be created through a process called "mining." Another key difference is that gold is predominantly used as a store of value, while Bitcoin is also used as a payment system. This means that you can use Bitcoin to buy goods and services just like you would with fiat currency. Lastly, gold is mostly owned by central banks and institutional investors, while Bitcoin is owned by a more diverse group of individuals and organizations. Overall, both assets have their own unique advantages and disadvantages. However, it seems clear that Bitcoin has the potential to become a major force in the global economy in the years ahead. Bitcoin And The Fiat System In the early days of Bitcoin, there was much speculation about whether the cryptocurrency would replace fiat currency. This question was largely debated in terms of whether or not Bitcoin could become a more widely used form of payment than fiat currency. While this debate is still ongoing, it's worth considering the possibility that Bitcoin may actually make the fiat system better off than it is today. There Are A Few Key Ways In Which Bitcoin Could Improve The Fiat System: 1. Increased transparency: One of the benefits of Bitcoin is that all transactions are recorded on a public ledger (the blockchain). This means that there is increased transparency around how money is being moved and used. In contrast, fiat currencies are often subject to central bank manipulation and other forms of corruption. 2. Reduced costs: Another advantage of Bitcoin is that it can be used to send money internationally without incurring high fees. For example, when sending money via traditional wire transfer, you typically have to pay a fee of around 3%. With Bitcoin, you can send money anywhere in the world for just a fraction of a cent. This reduced cost could potentially lead to more people using Bitcoin as a primary form of payment. 3. Protection from inflation: Fiat currencies are often subject to inflationary pressures, which can erode the purchasing power of consumers over time. In contrast, Bitcoin has a limited supply of 21 million coins and cannot be subjected to inflationary pressures in the same way as fiat currencies. This makes Bitcoin a Is It Really Better To Have Crypto Than Just Cash? It's no secret that Bitcoin has had its ups and downs over the years. While the price of Bitcoin has fluctuated wildly, it's still up overall since its inception. And, as we've seen in recent months, when the economy takes a turn for the worse, Bitcoin tends to do quite well. There are a few reasons why crypto may be a better bet than cash in the long run. First, as we've seen with other asset bubbles like housing, cash can lose its value quickly in a downturn. Second, crypto is much more portable than cash - you can easily carry around a digital wallet with all your assets stored safely offline. Finally, crypto is much more divisible than cash - you can easily split up your assets into small pieces and trade them on exchanges or use them to make purchases. In the end, it's up to each individual to decide whether they think crypto is a better investment than cash. But if you're looking for something that has the potential to hold its value in tough times and that you can easily take with you wherever you go, crypto may be worth considering. What Is The Difference Between Investing In Cryptocurrency And Gambling? The main difference between investing in cryptocurrency and gambling is that with investing you are buying an asset with the expectation that it will go up in value over time. With gambling, you are placing a bet on an event with the hope of winning money, but with no guarantee that you will actually make any money. With investing, you are trying to make money by buying low and selling high. You are looking at the long-term potential of an investment and are willing to hold onto it for a while. With gambling, you are trying to make money by luck. You may win some money in the short-term, but there is no guarantee that you will actually make any money in the long-term. Investing is a riskier proposition than gambling, but it can also be more rewarding. If you invest wisely, you can make a lot of money. However, if you gamble and don't know what you're doing, you can lose everything. So, which is better? It depends on your goals and your personality. If you're risk-averse and just want to make some quick cash, then gambling may be a better option for you. However, if you're looking to make a long-term investment and are willing to take on more risk, then investing in cryptocurrency may be the better choice. Bitcoin has come a long way in its short lifespan, and it seems to only be getting stronger. Despite all the ups and downs, we may be better off than ever before. With more businesses starting to accept Bitcoin and more people becoming interested in cryptocurrencies, it's safe to say that Bitcoin is here to stay. Who knows where we'll be in another 14 years?  Julien Mignot for The New York Times; Julien De Rosa/Agence France-Presse — Getty Images Julien Mignot for The New York Times; Julien De Rosa/Agence France-Presse — Getty Images If you have been wondering why Balenciaga was not making any statement following Ye's removal from both Twitter and Instagram, it is because they were not talking but sending a message trough action. On October 19th 2022, Kanye West lost his Balenciaga's endorsement. People started to notice an instant erasure of Kanye's products from their portfolio, that included any site properties and stores worldwide. There is no trace of Ye's products today. With this latest controversy, Ye's detractors were also joined by Balenciaga, who has distanced themselves from Ye by removing any mentions of him on their website. In the days immediately following Ye's promotion of antisemitism and racism on social media, Balenciaga remained silent before finally releasing a statement yesterday denouncing his actions. It is notable that Ye apologized in the last 48 hours during a new interview with Piers Morgan, rapper Kanye West has called out Sky News Australia host Piers Morgan for being "wack," and accuses the host of failing to hold accountability for his actions. Kanye West addressed Piers Morgan and told him he was a "Karen." according to the host he took 2 hours for Ye' to offer an apology. After Kanye West's recent comments at his show, they removed their "Yeezy Gap Engineered By Balenciaga" line from all online retailers, including their own. They also took down the picture of Kayne walking for Balenciaga SS 2016 from Vogue Runway. These silent and professional actions speak louder than words about the brand's reaction to Kanye West's behavior and decision to remove him from being a designer for the line. This all started when the audience at Kanye West's latest fashion show saw slogan t-shirts branded with "while lives matter" come down the runway. Kanye defended the slogan in a post on Instagram, after many people said that it was insensitive, un-empathetic, and even downright racist. After continuing to post inappropriate messages and images on Instagram and YouTube, Ye was eventually banned from those sites. Since then, various brands, publications, and celebrities have spoken out about the subject and distanced themselves from his views; Balenciaga was one of the last ones to comment. If you think Kanye's remarks are unforgivable, wait until you hear what else some celebrities have done! But even if they do get grounded out of the game, they can still make comebacks. Some brands and designers who behaved similarly in the past have relied on celebrity endorsements and high-profile collaborations to help revive their careers. So maybe Ye's exclusion will just be a temporary thing. Ye is a multi Billionaire; at Hotrillion we believe that what will happen to the artist and mogul formerly known as Kanye West may just be taught in Business/ Marketing classes at NYU Stern Or Columbia Business. A |

hot trillion blogThe Highest quality; potential or result is the standard here. Email our admin Djamee at [email protected] for placement and editorial opportunities on HotTrillion.com Archives

February 2024

CategoriesAll 000 Dolars 33K Bitcoin 7 Reasons To Invest In Gold Ada Aka Automobile Storage Vehicle Storage Airport Parking Indoor Car Storage Auto Storage USA Awn Powered By Stellar Billions Bitcoi Correction Bitcoin Bitcoin All Time High Bitcoin Etf Bitcoinlaser Eyes To 100K Bitcoin President Of El Salvador Bitcoins Millions Bitcoinspot Etf Bitcoin To 100 Blockchain Blockchains Blockchain Technology Blockchain Trchnology Btc Bukale Re Elected In El Salvador Can Cardamon Hit $10 Cardano Cardano Africa Cardanoafrica 2021 Cardano Africa Announcement Cardano Africa News Cardano Africa Plan Cardanoafrica Project Cardanoafrica Special Cardano Crypto Revolution In Africa Cardano Hottrillion.com Cardanoreddit Charles Charles Hoskinsonn Coinbase Crypto Cryptocurrency Crypto Exchange FTX Dav Davor Davor Coin Decentralized Blockchain Cardano Defi Developers Dr G Jones Ethiopia Faares Quadri Get Free Bitcoin Hodl How Can I Buy Akon Akoin How To Buy Ada How To Buy Cardano How To Lend On Davor How To Make Money Online Investment Investment Platform Is Cardamon Better Than Bitcoin Is Cardano A Good Investment In 2021 Laser Eye Mainnet Millionnaires Millions Nlp Rising Stars Sam Bankman-Fried Slall Conrect Topcrypto Trillion Trillions Vanguard What Is Cardamon Worth In 2025 What's Happening In Africa With Ada Cardao When To Buy Cardano Worldcoin Worldcoin $5million Dollars Grant Worldcoinfondation |

HotTrillion.comHotTrillion © is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designated to provide a means for sites to earn advertising fees by advertising and linking to amazon.com |

|

© 2017 HotTrillion.com. All Rights Reserved. Powered By Djamee Enterprise

RSS Feed

RSS Feed